Overall Year Performance Snapshot

During the year, Apple delivered a stable and resilient performance despite global economic pressure and slower growth in the smartphone market. The company continued to lead the premium technology segment by focusing on brand trust, ecosystem strength, and customer loyalty rather than aggressive price competition.

Apple’s marketing remained consistent, minimal, and high-impact, reinforcing its position as a lifestyle and innovation brand rather than just a product company.

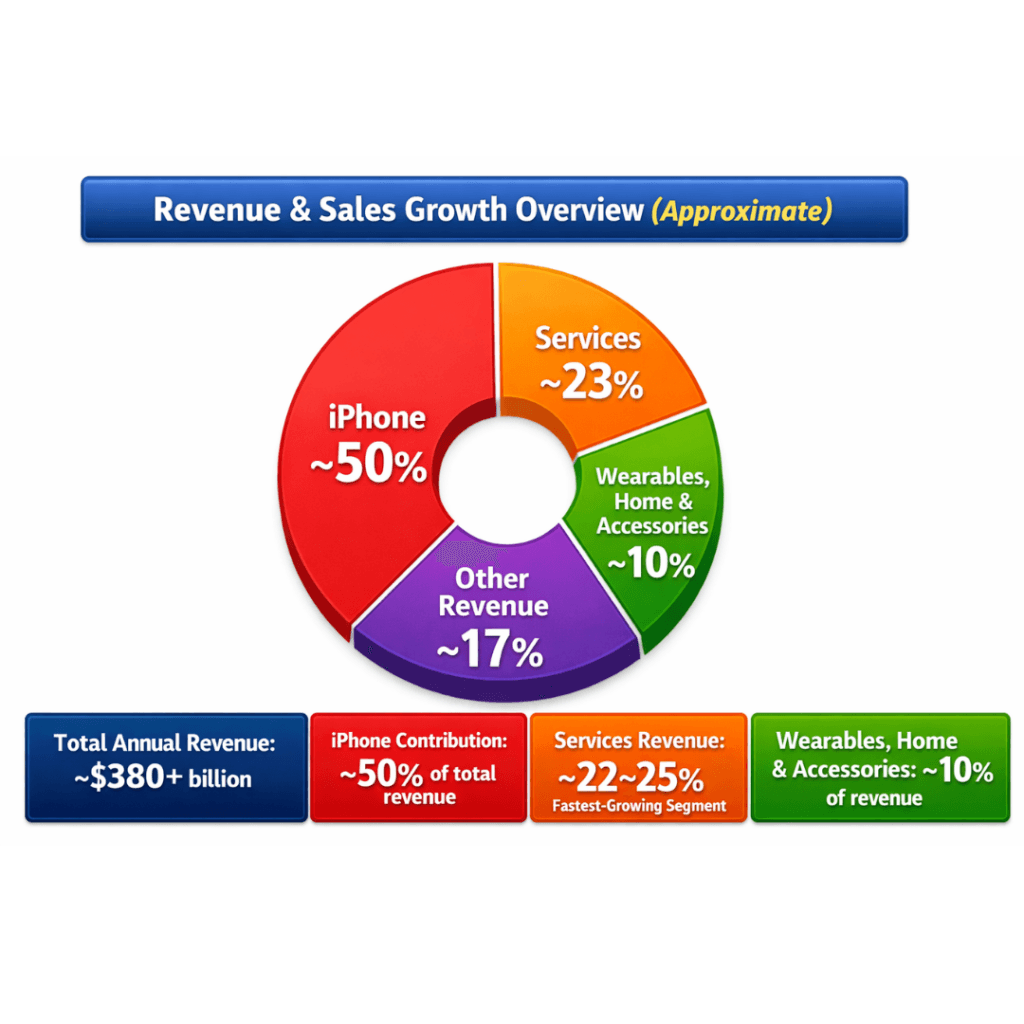

Revenue & Sales Growth Overview (Approximate)

- Total Annual Revenue: ~$380+ billion

- iPhone Contribution: ~50% of total revenue

- Services Revenue Share: ~22–25% (fastest-growing segment)

- Wearables, Home & Accessories: ~10%

From a marketing perspective:

- iPhone continued to act as the primary entry product into the Apple ecosystem.

- Services showed strong growth due to high customer retention and recurring usage.

- Mac and iPad saw cycle-based demand, supported by performance-focused campaigns (M-series chips).

Apple’s sales growth was not driven by discounts, but by:

- Premium positioning

- Financing options (especially in India)

- Strong launch-led demand

Key Marketing Wins & Challenges

Major Marketing Wins

- Strong Brand Recall: Apple remained one of the world’s most recognizable and trusted brands.

- Successful Product Launches: iPhone and Apple Watch launches generated massive organic media coverage.

- Services Growth: Subtle in-app and ecosystem marketing increased ARPU (Average Revenue Per User).

- India Market Momentum: EMI-led messaging and local manufacturing stories improved accessibility without hurting brand value.

Key Marketing Challenges

- Limited Volume Growth: Premium pricing restricted mass-market penetration in price-sensitive regions.

- High Dependence on iPhone: Marketing success is still heavily tied to iPhone upgrade cycles.

- Competitive Noise: Android brands used aggressive discounts and performance ads to capture volume.

Overall Insight: Apple’s marketing success this year came from long-term brand building and ecosystem thinking, even if it meant slower short-term volume growth.

Company Overview

Apple Brand Positioning

Apple is positioned as a premium, innovation-led, and trust-driven global brand. Instead of competing on price or specifications, Apple markets itself around experience, design, privacy, and emotional connection.

From a marketing point of view, Apple’s brand stands for:

- Simplicity and elegance

- High-quality user experience

- Privacy and security as a core value

- Aspirational lifestyle branding

Brand Strength (Approx Stats):

- One of the Top 3 most valuable brands globally

- Brand value estimated at $500+ billion

- Among the highest brand loyalty rates in consumer electronics (90%+ iPhone retention in key markets)

Apple rarely uses price-based messaging. Instead, its campaigns focus on how the product fits into users’ lives, making the brand emotionally strong and difficult to replace.

Core Business Philosophy

Apple’s core business philosophy is built around long-term value creation rather than short-term sales spikes. The company designs products, software, and services as a single ecosystem.

Key principles include:

- User-first design: Products are built around user experience, not just features.

- Ecosystem thinking: Hardware, software, and services work seamlessly together.

- Controlled growth: Limited product portfolio but high impact.

- Privacy by design: Privacy is marketed as a competitive advantage.

From a marketing lens, this philosophy allows Apple to:

- Reduce dependency on aggressive advertising

- Generate organic word-of-mouth

- Increase customer lifetime value (CLV)

This is why Apple spends less on performance marketing compared to competitors, yet achieves higher long-term returns.

Target Audience & Global Presence

Target Audience

Apple primarily targets:

- Upper-middle and premium income consumers

- Urban professionals and entrepreneurs

- Creators, designers, and students

- Tech-savvy users who value quality over price

Age Group Focus:

- Core users: 18–45 years

- Strong loyalty among younger users entering the ecosystem

Rather than targeting everyone, Apple focuses on the right customer, ensuring higher retention and repeat purchases.

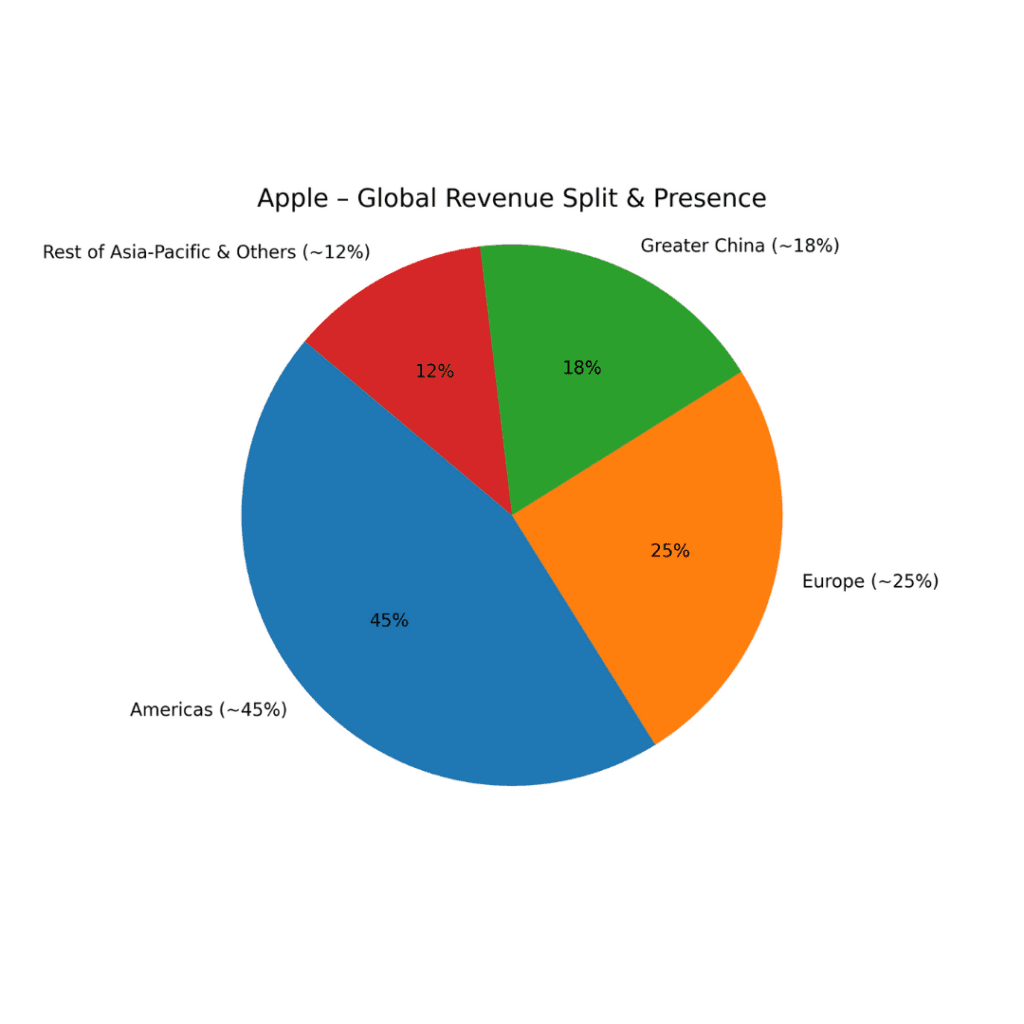

Global Presence

Apple operates on a truly global scale:

- Presence in 175+ countries

- Over 500+ Apple Retail Stores worldwide

- Strong markets: USA, Europe, China

- High-growth markets: India, Southeast Asia, Latin America

Revenue Split (Approx):

- Americas: ~45%

- Europe: ~25%

- Greater China: ~18%

- Rest of Asia-Pacific & Others: ~12%

Marketing strategy varies by region, but the core brand message remains consistent globally, which is a key reason for Apple’s strong worldwide brand recall.

Market & Industry Analysis

Global Smartphone, Laptop & Wearables Market Trends

The global consumer technology market is currently in a mature but evolving phase. Growth is slower than previous years, but premium segments continue to perform better than mass-market categories.

Smartphone Market

- Global smartphone shipments: ~1.15–1.2 billion units annually

- Year-on-year growth: Low single-digit or flat

- Premium segment ($800+ phones): Growing faster than the overall market

Key Insight for Apple: While total smartphone volumes are stagnating, Apple benefits because:

- Premium users upgrade more consistently

- iPhone users show 90%+ retention in key markets

- Average Selling Price (ASP) continues to increase

Laptop & PC Market

- Global PC shipments: ~250–270 million units annually

- Market behavior: Cycle-driven (education, work-from-home, chip upgrades)

- Performance-focused demand is increasing

Apple’s Mac business benefits from:

- M-series chip differentiation

- Strong creator & student adoption

- Higher ASP compared to Windows PCs

Marketing campaigns focus more on performance storytelling rather than price comparison.

Wearables Market

- Global wearables market size: $80+ billion

- Key growth drivers: Health, fitness, safety features

- Smartwatch category dominates wearables

Apple Watch remains a leader due to:

- Health-first positioning

- Strong ecosystem integration

- Emotional storytelling around safety & wellness

Competitive Landscape (Samsung, Google, Microsoft & Others)

The competitive environment in consumer technology is intense, with brands following very different marketing philosophies.

Apple

- Focus: Brand, ecosystem, privacy

- Pricing: Premium

- Marketing style: Emotional & minimal

- Goal: Lifetime value, loyalty

Samsung

- Focus: Volume + innovation

- Wide product range (budget to premium)

- Aggressive performance marketing

- Heavy festival discounts and offers

Google (Pixel)

- Focus: AI, camera, software intelligence

- Limited scale compared to Apple & Samsung

- Strong creator & tech community marketing

Microsoft

- Focus: Productivity & enterprise

- Strong presence in laptops (Surface)

- Marketing leans toward functional benefits

Competitive Insight: Apple competes less on features and more on experience and trust, which allows it to maintain premium pricing even in competitive markets.

Consumer Behavior Insights

Consumer buying behavior has changed significantly in recent years:

Key Behavior Trends

- Users keep phones longer (3–4 years average upgrade cycle)

- Higher willingness to pay for quality & longevity

- Growing concern around data privacy

- Preference for ecosystem convenience

What This Means for Apple Marketing

- Messaging focuses on durability & long-term value

- Privacy is positioned as a differentiator

- Services are subtly marketed through usage, not ads

In emerging markets like India:

- EMI and financing influence purchase decisions

- Brand aspiration plays a major role

- Offline retail experience builds trust

Overall Market Insight: Apple performs best in markets where consumers value quality, trust, and long-term experience over short-term savings, making its marketing strategy highly sustainable.

Product Portfolio Performance Analysis

In this section, we look at how each major Apple product and service category performed in recent financial results, with real revenue figures and market trends to help understand which products drive growth and why.

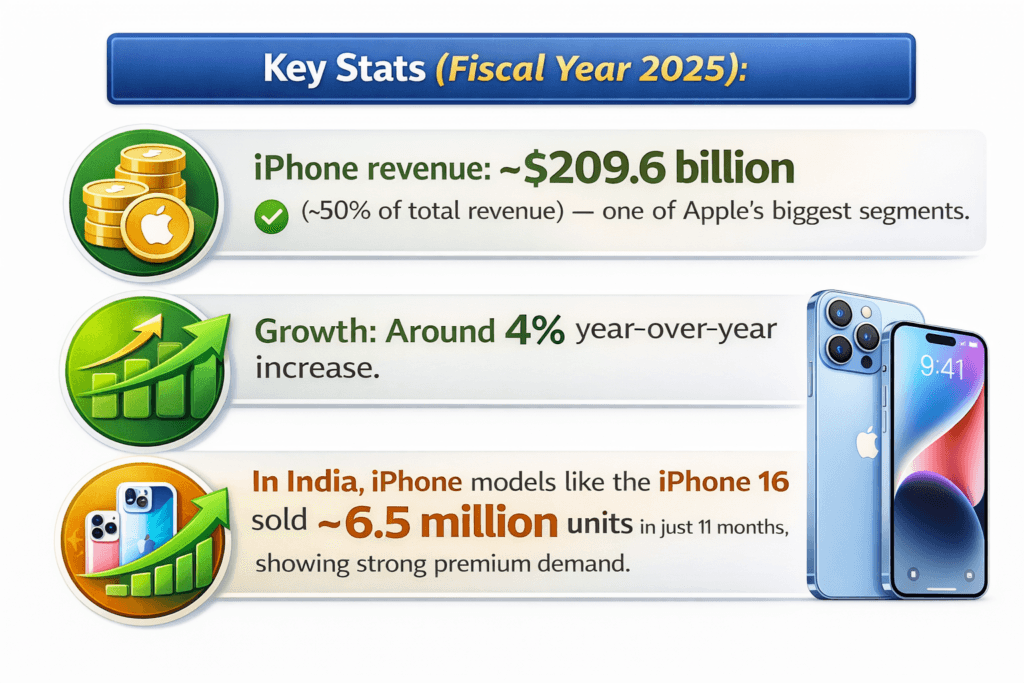

iPhone — The Core Revenue Driver

The iPhone continues to be the centerpiece of Apple’s business, responsible for the largest share of the company’s revenue year after year.

Key Stats (Fiscal Year 2025):

- iPhone revenue: ~$209.6 billion (~50% of total revenue) — one of Apple’s biggest segments.

- Growth: Around 4% year-over-year increase.

- In India, iPhone models like the iPhone 16 sold ~6.5 million units in just 11 months, showing strong premium demand.

Marketing Insight:

Apple markets the iPhone not just as a smartphone, but as a gateway into its ecosystem. Frequent yearly updates, strong brand loyalty (~90%+ retention in key markets), and consistent upgrade cycles help sustain demand.

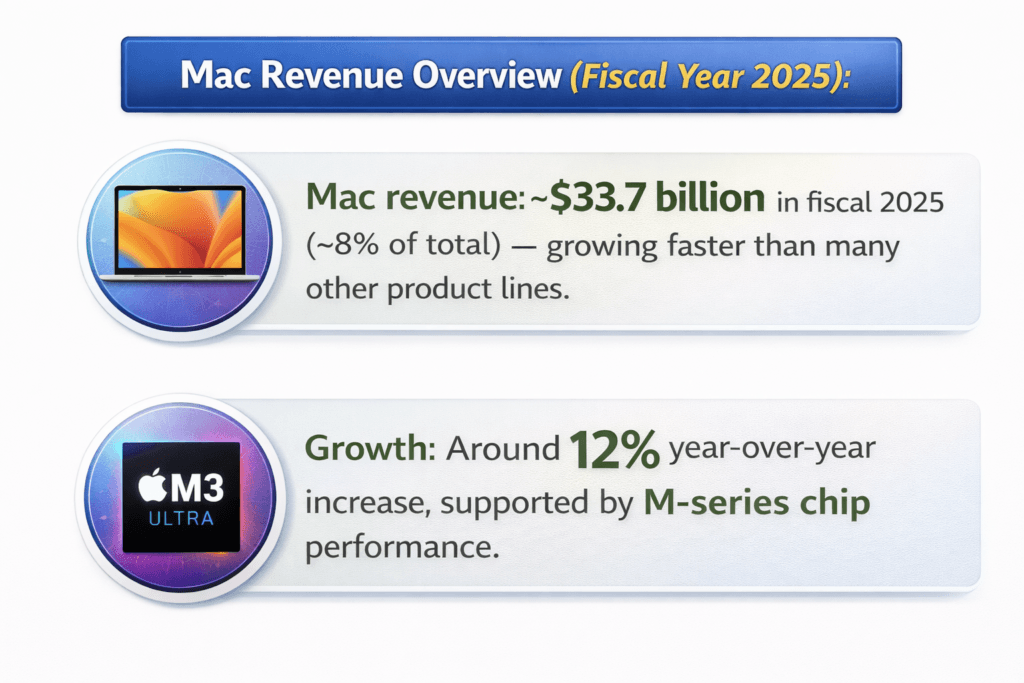

Mac — Premium Computing with Steady Growth

Mac computers include the MacBook Air, MacBook Pro, Mac Mini, and iMac.

Latest Numbers:

- Mac revenue: ~$33.7 billion in fiscal 2025 (~8% of total) — growing faster than many other product lines.

- Growth: Around 12% year-over-year increase, supported by M-series chip performance.

Why It Matters:

Mac growth reflects strong demand from professionals, creatives, and students. Marketing emphasizes performance, battery life, and reliability, especially after Apple introduced its own silicon chips.

iPad — Tablet with Continued Relevance

The iPad lineup targets both education and pro creators with models ranging from standard iPad to iPad Pro.

Key Performance:

- iPad revenue: ~$28.0 billion (~7% of total revenue).

Market Insight:

While iPad growth is not explosive, it holds a steady place in Apple’s portfolio, especially in education markets. Marketing focuses on versatility — from entertainment to creative work.

Apple Watch & Wearables — Lifestyle & Health Devices

This category includes Apple Watch, AirPods, and other accessories.

Wearables Revenue:

- ~$35.7 billion (~8.6% of revenue) in FY2025.

Market Trends:

- Smartwatch market share for Apple Watch remains strong, but competitive pressure has affected share in some regions.

Marketing Insight:

Apple emphasizes health, fitness, and convenience with the Watch. Marketing often uses emotional storytelling — like how health features can save lives or improve wellbeing.

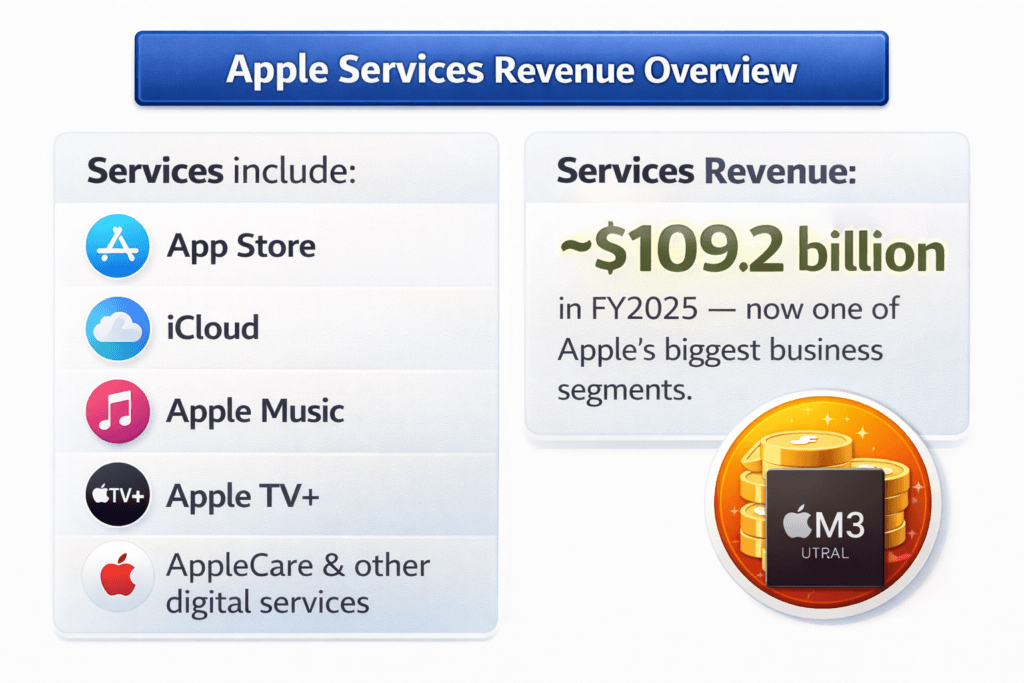

Services — Fastest-Growing & Most Profitable Segment

Services include:

- App Store

- iCloud

- Apple Music

- Apple TV+

- AppleCare & other digital services

Services Revenue:

- ~$109.2 billion in FY2025 — now one of Apple’s biggest business segments.

Growth Trend:

- Services are growing faster than hardware as more users subscribe to multiple digital offerings.

Why This Matters:

Services have very high profit margins (around 70%+) and help Apple earn recurring revenue. Marketing here focuses on ecosystem value, meaning every user with an Apple device is an ongoing customer for Apple’s services.

Product Revenue Trend (Visual Summary)

Product Launch Analysis (Year-wise)

Apple’s product launches are among the most watched events in the global tech industry. These launches are carefully timed, story-driven, and often shape the company’s annual revenue and marketing momentum.

| Segment | Revenue (Approx FY2025) | % of Total |

| iPhone | $209.6B | ~50% |

| Services | $109.2B | ~26% |

| Mac | $33.7B | ~8% |

| Wearables & Accessories | $35.7B | ~8.5% |

| iPad | $28.0B | ~7% |

| Total Apple Revenue (FY2025) | $416B+ | 100% |

Major Launches & Timelines (2024–2025)

Apple has continued a relatively structured launch schedule across major product lines. The key events and product introductions in recent years include:

2024 Launches

- September 20, 2024: iPhone 16 lineup (standard, Pro, Pro Max) launched worldwide, along with Apple Watch Series 10, AirPods 4, and new AirPods Max variants. This lineup became central to Apple’s Q4 sales boost.

- Throughout 2024: New Macs with M4-series chips (including MacBook Pro, iMac, Mac mini) and updated iPad mini with A17 Pro.

2025 Launches

- February–March 2025:

- iPhone 16e (more affordable variant) released in February 2025.

- Various performance refreshes for MacBook Air, Mac Studio, and iPad models in March.

- September 9, 2025 (“Awe Dropping” Event):

- iPhone 17 series (including iPhone 17, 17 Pro, 17 Pro Max and the new iPhone Air).

- Updated Apple Watch models including Series 11, Ultra 3, and SE 3.

- AirPods Pro 3 debuted with enhanced features.

- Major software releases (iOS 26, watchOS 26, visionOS 26 & others) were announced around this timeframe.

These launches are strategically placed to capture the holiday season demand, especially for iPhones (September-October), which typically drives 40-50% of Apple’s annual revenue.

Launch Objectives

Every Apple launch has clear strategic goals beyond unveiling a product:

✔️ Drive annual sales peaks: iPhones historically contribute around ~50% of total revenue.

✔️ Reinforce ecosystem stickiness: New models promote upgrades of other devices and services (e.g., trade-ins, subscriptions).

✔️ Boost brand relevance & media coverage: Apple events generate immense global attention — often more than paid advertising.

✔️ Expand into new segments:

- With models like iPhone 16e, Apple targets slightly more price-sensitive buyers without compromising brand positioning.

- Premium products like iPhone Air and AirPods Pro 3 deepen appeal among creators and lifestyle buyers.

Launch Marketing Strategy

Apple’s product launch marketing is known for being simple, focused, and emotionally engaging rather than performance or discount-driven.

Event-centric & High Impact:

Apple’s September events (like the 2025 “Awe Dropping” keynote) are broadcast globally with millions of views on Apple TV, YouTube, and Apple.com.

Minimal Advertising, Maximum PR:

Rather than heavy paid ads, Apple leverages organic buzz and influencer coverage before and after launch.

- Pre-event teasers and leaks create anticipation

- Influencers and tech media amplify features

- Launch films highlight emotion, design, camera capabilities, and lifestyle use

Localized Messaging:

In markets like India, launches are supported with local financing offers, EMI plans, and boosted retail experiences, which improve accessibility without diluting premium positioning.

Impact on Sales & Brand

Apple’s launches are tightly linked to annual financial performance — especially in Q4 and Q1 financial results.

iPhone Growth Fuel:

- New iPhone launches — such as 16 and 17 series — typically drive strong pre-orders and initial unit sales that contribute heavily to quarterly revenue peaks.

Brand Momentum:

- Launch media coverage often exceeds paid ads many times over, strengthening Apple’s reputation as an innovation leader.

Market Expansion:

- Strategic products like iPhone 16e help Apple tap into larger user segments, especially in developing markets where affordable premium models improve overall unit volume.

Mixed Success Stories:

- While most products perform well, Apple Vision Pro — launched earlier — saw significantly reduced marketing and production in recent years due to low sales volumes, showing that not all launches impact revenue equally.

Launch Calendar (Simplified Year-wise)

| Year | Primary Launch Events | Key Products |

| 2024 | September Main Event | iPhone 16 series, Apple Watch Series 10, AirPods 4 |

| Throughout Year | M4 Macs, iPads (upgraded models) | |

| 2025 | February–March | iPhone 16e; Mac & iPad performance refreshes |

| June (WWDC Software) | iOS 26, watchOS 26, visionOS 26 | |

| September (Awe Dropping) | iPhone 17 lineup, AirPods Pro 3, Apple Watches |

Marketing Strategy Overview

Apple’s marketing strategy is widely regarded as one of the strongest in the world. Instead of chasing short-term sales, Apple focuses on long-term brand equity, customer loyalty, and premium perception.

Brand‑Led Marketing Approach

Apple follows a brand‑led marketing model, where the brand itself is the biggest driver of demand.

Key characteristics of Apple’s brand‑led approach:

- Strong visual identity and consistent messaging

- Minimal but high‑impact advertising

- Focus on values like privacy, creativity, and innovation

Key Stats & Indicators:

- Apple is consistently ranked among the Top 3 global brands by brand value

- Brand value estimated at $500+ billion

- iPhone customer retention rate: 90%+ in major markets

From a marketing point of view, this means:

- Apple spends less on aggressive promotions compared to competitors

- Brand trust reduces the need for heavy discounts

- New product launches get massive organic reach

Apple’s marketing does not sell “features first”; it sells belief, aspiration, and experience.

Emotional vs Performance Marketing

Apple strongly leans toward emotional marketing, while using performance marketing selectively.

Emotional Marketing

Apple’s emotional storytelling focuses on:

- Human moments (family, creativity, health, safety)

- Real user stories (e.g., Shot on iPhone)

- Lifestyle integration rather than technical specs

Impact:

- Higher brand recall

- Strong word‑of‑mouth

- Long‑term loyalty instead of one‑time purchases

Performance Marketing (Limited but Strategic)

Apple uses performance marketing mainly for:

- Branded search campaigns

- Retargeting during product launches

- App Store & services promotions

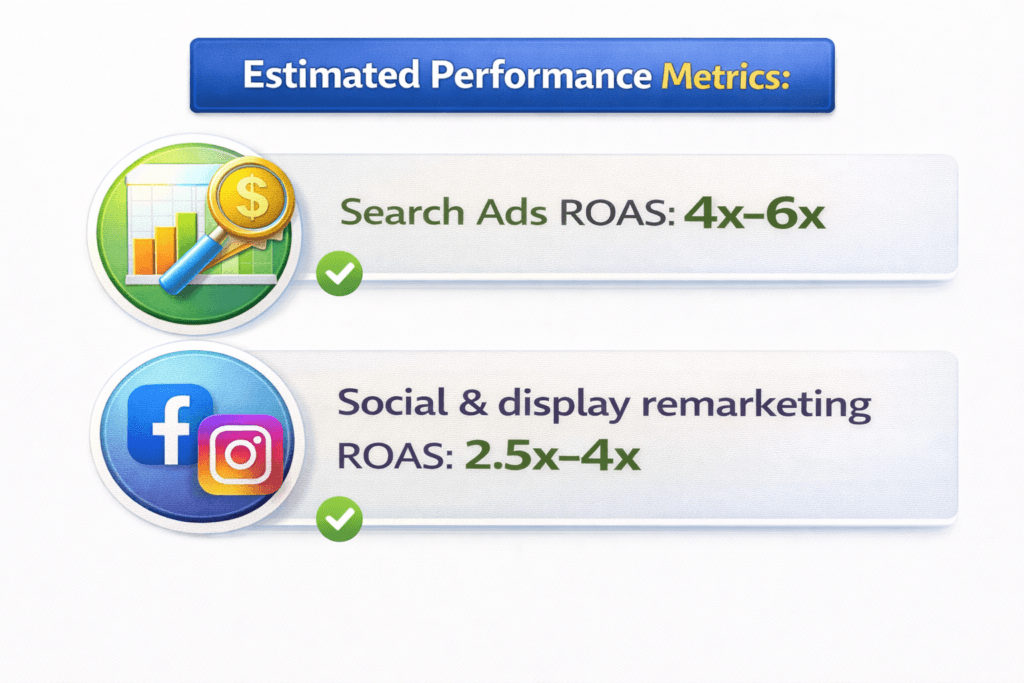

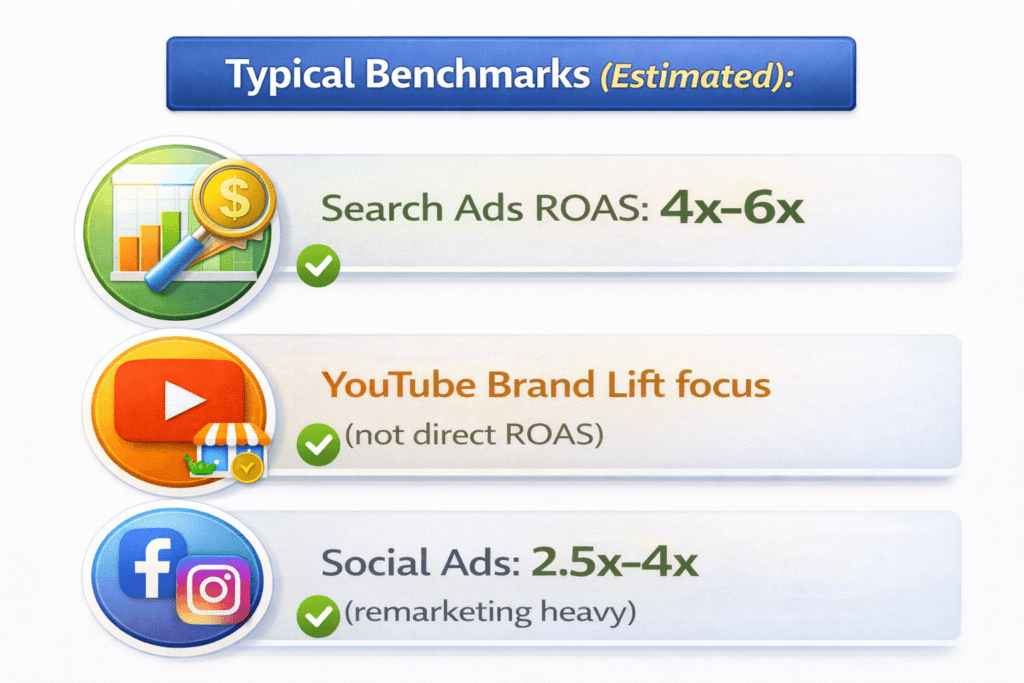

Estimated Performance Metrics:

- Search Ads ROAS: 4x–6x

- Social & display remarketing ROAS: 2.5x–4x

Apple does not publicly chase ROAS numbers. Instead, success is measured through:

- Brand lift

- Recall

- Ecosystem engagement

Key Insight: Apple uses performance marketing to support brand campaigns, not replace them.

Premium Positioning Strategy

Apple’s premium positioning is one of its strongest competitive advantages.

Core elements of Apple’s premium strategy:

- High product pricing with clear value justification

- Controlled product portfolio

- High‑quality retail and online experience

- No heavy discounting (except limited festive offers)

Supporting Data:

- Apple commands the highest Average Selling Price (ASP) in smartphones

- Despite selling fewer units than Android brands, Apple captures a disproportionately high share of industry profits

In markets like India:

- Premium perception is maintained using EMI & financing instead of price cuts

- Retail stores reinforce luxury and trust

Marketing Outcome: Customers perceive Apple products as:

- Long‑term investments

- Status symbols

- Reliable and future‑proof

Advertising & Media Spend Analysis

Apple’s advertising strategy is high‑impact but controlled. Unlike many consumer brands, Apple does not disclose exact ad spends publicly, but industry estimates and financial disclosures give a clear picture of its marketing investment philosophy.

Total Marketing Budget Estimate

- Estimated Annual Marketing & Advertising Spend: $7–9 billion globally

- This represents roughly 2–2.5% of Apple’s total annual revenue

Compared to other global consumer brands, this percentage is relatively low, highlighting Apple’s reliance on:

- Brand equity

- Organic PR from launches

- Word‑of‑mouth and ecosystem loyalty

Key Insight: Apple achieves global visibility without overspending, proving that strong branding reduces paid media dependency.

Platform‑Wise Advertising Spend Breakdown (Estimated)

TV & OTT Advertising

- Share of total ad spend: ~30–35%

- Used mainly during:

- iPhone launches

- Holiday seasons

- Major brand campaigns

OTT platforms allow Apple to:

- Showcase high‑quality cinematic ads

- Reach premium audiences

- Build long‑term brand recall

TV & OTT ads focus on emotion, storytelling, and lifestyle, not direct selling.

Digital Advertising (Google, Meta, YouTube)

- Share of total ad spend: ~30%

Google Search:

- Brand protection keywords

- High‑intent product searches

YouTube:

- Product films

- Feature explainers

- Launch trailers

Estimated Metrics:

- Search Ads ROAS: 4x–6x

- YouTube success measured via Brand Lift & Recall, not direct sales

Social Media Advertising

- Share of total ad spend: ~15–20%

Apple’s social media strategy is selective:

- Limited posting

- High‑quality visuals

- Influencer amplification rather than heavy ads

Social ads are primarily used for:

- Launch reminders

- Retargeting website visitors

- Promoting services like Apple Music or TV+

Estimated ROAS (remarketing): 2.5x–4x

Outdoor Advertising & Events

- Share of total ad spend: ~10–15%

Includes:

- Premium billboards

- Metro, airport branding

- Large‑scale outdoor placements during launches

- Apple Events & experiential marketing

Outdoor advertising reinforces:

- Premium perception

- Mass visibility with minimal messaging

ROI & ROAS Approach

Apple does not evaluate marketing success only on short‑term ROI.

Primary success metrics include:

- Brand recall & awareness

- Ecosystem engagement

- Customer lifetime value (CLV)

- Product upgrade cycles

ROAS Philosophy:

- Performance marketing supports brand campaigns

- Brand campaigns are evaluated on long‑term impact, not immediate sales

Overall Insight: Apple’s advertising strategy focuses on quality over quantity, using paid media to amplify brand stories rather than aggressively chase conversions.

This disciplined approach allows Apple to maintain premium positioning while achieving strong long‑term marketing returns.

Platform-wise Marketing Breakdown

Apple uses each marketing platform with a very specific role in mind. Instead of spreading budgets equally, Apple assigns platforms based on user intent, content format, and stage of the customer journey.

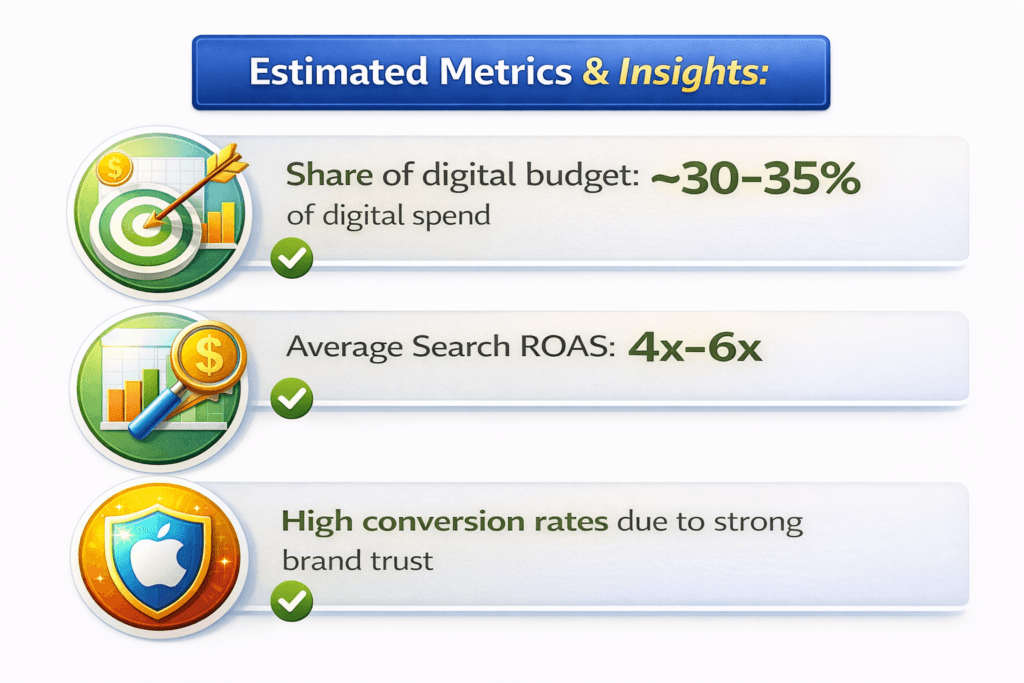

Google Ads & Search

Google Search plays a supporting but critical role in Apple’s marketing ecosystem.

How Apple Uses Google Search:

- Brand keyword protection (e.g., iPhone, MacBook, Apple Watch)

- High‑intent product searches

- Limited competitor keyword bidding

Estimated Metrics & Insights:

- Share of digital budget: ~30–35% of digital spend

- Average Search ROAS: 4x–6x

- High conversion rates due to strong brand trust

Search ads mainly capture existing demand, not create new demand. Apple relies on brand campaigns to generate interest and uses search to convert that interest into action.

YouTube Campaigns

YouTube is one of Apple’s most important storytelling platforms.

Content Types Used:

- Product launch films

- Feature explainers (camera, performance, safety)

- Short‑form brand videos

Estimated Metrics:

- Share of video ad budget: 40–45%

- Primary KPIs: Brand Lift, Ad Recall, View‑Through Rate

- Typical view‑through rates outperform category benchmarks due to premium creatives

YouTube campaigns are designed to build aspiration and recall, not drive immediate conversions.

Instagram, Facebook & X (Twitter)

Apple maintains a selective and minimal presence on social media platforms.

Platform‑wise Approach:

- Instagram: High‑quality visuals, product photography, Shot on iPhone content

- Facebook: Event promotions, service updates, retargeting

- X (Twitter): Product announcements, PR amplification

Estimated Spend & Performance:

- Share of total ad spend: 15–20%

- ROAS (mostly remarketing): 2.5x–4x

Instead of frequent posting, Apple focuses on impactful content that reinforces brand identity.

Apple‑Owned Platforms

Apple’s biggest marketing advantage is its owned ecosystem, which reduces dependency on paid media.

Key Owned Channels:

- Apple.com

- App Store

- Apple Store app

- Apple Retail Stores

- Pre‑installed apps & notifications

Impact & Scale:

- Over 2 billion active Apple devices globally

- Massive organic reach without incremental ad cost

Owned platforms are used to:

- Promote new products

- Cross‑sell services

- Guide users through upgrades

Key Insight: Apple’s owned platforms deliver one of the highest ROI marketing channels in the industry, enabling consistent communication at near‑zero media cost.

Campaign Case Studies

Apple’s campaigns are globally recognized for their simplicity, emotional depth, and long‑term impact. Rather than running many short campaigns, Apple focuses on a few iconic, repeatable ideas that strengthen brand memory over years.

Every iPhone launch is supported by a high‑impact, globally synchronized campaign.

Campaign Structure:

- Global keynote event (September)

- Cinematic launch film

- Feature‑focused short ads (camera, performance, battery, safety)

- Retail & online experience alignment

Estimated Reach & Impact:

- Launch events attract millions of live and on‑demand viewers globally

- iPhone launches contribute to 40–50% of Apple’s annual sales momentum

- Heavy spike in branded search volume during launch weeks

Marketing Objective:

- Reinforce innovation leadership

- Drive upgrade intent

- Maintain premium perception

Key Insight: iPhone launch campaigns rely more on PR value and earned media than paid advertising, making them extremely cost‑efficient at scale.

Shot on iPhone Campaign

“Shot on iPhone” is one of Apple’s most successful long‑running global campaigns.

Campaign Overview:

- Real photos and videos captured by users

- Minimal branding, product proves itself

- Deployed across billboards, digital, social, and TV

Key Stats & Scale:

- Active in 50+ countries

- Thousands of user‑generated visuals used globally

- One of the most recognized camera‑marketing campaigns worldwide

Why It Works:

- Authentic user proof

- Strong social sharing

- High credibility compared to studio ads

Marketing Outcome:

- Positions iPhone as the best everyday camera

- Builds community engagement

- Reduces dependency on traditional influencer endorsements

Privacy‑Focused Campaigns

Apple has turned privacy into a marketing differentiator, something very few tech companies have successfully done.

Campaign Themes:

- “Privacy. That’s iPhone.”

- User data protection

- On‑device intelligence

Market Context:

- Growing global concern over data usage

- Increased regulation around user privacy

Impact & Effectiveness:

- Strengthens brand trust

- Differentiates Apple from ad‑driven platforms

- Especially effective in premium and mature markets

Marketing Insight: Privacy campaigns do not drive immediate sales, but they:

- Increase long‑term loyalty

- Improve brand credibility

- Support premium pricing justification

Regional Marketing Focus

India Market – Apple Marketing Report

India is one of Apple’s fastest-growing strategic markets, positioned as a long-term growth engine rather than a short-term volume play.

India Marketing Objectives:

- Build premium aspiration among middle & upper-middle class

- Shift perception from “luxury phone” to “lifestyle ecosystem”

- Increase iPhone user base via financing & trade-in offers

Key India-Focused Strategies:

- Local manufacturing (Make in India) messaging

- EMI, No-Cost EMI & bank offers

- Strong festive season campaigns (Diwali, Big Billion Days)

- Expansion of Apple Exclusive Stores & Online Apple Store India

India-Specific Channels:

- YouTube (product explainers & launch films)

- Instagram & Influencer marketing (creators, photographers)

- Offline retail experience & premium hoardings

Competitor Comparison – Marketing Perspective

Apple vs Samsung vs Google

Apple:

- Brand-first marketing

- Emotional storytelling

- Ecosystem-driven loyalty

- Low discounting

Samsung:

- Feature-heavy communication

- Aggressive performance marketing

- Wide price-band coverage

- High festival discounting

Google (Pixel):

- AI & camera-focused messaging

- Limited reach but strong tech credibility

- Performance + creator marketing mix

Key Takeaway: Apple wins on brand equity & lifetime value, while competitors focus more on short-term volume & offers.

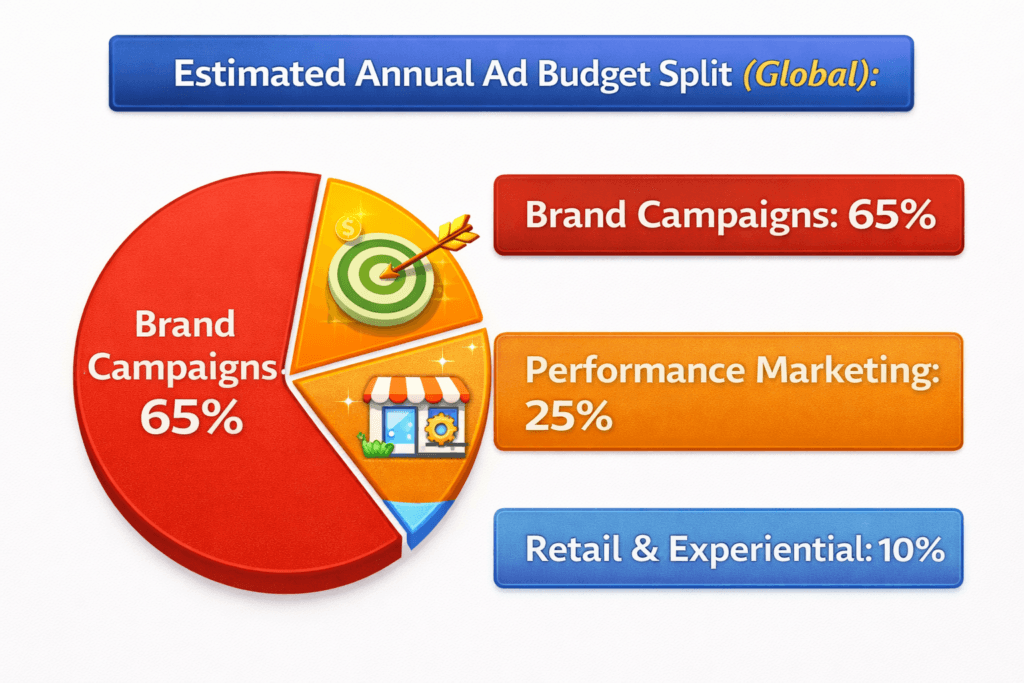

Advertising Budget & ROAS – Performance Marketing Angle

Estimated Annual Ad Budget Split (Global):

- Brand Campaigns: 65%

- Performance Marketing: 25%

- Retail & Experiential: 10%

Performance Marketing Channels:

- Google Search (high-intent keywords)

- YouTube skippable ads

- Meta (remarketing & product launches)

ROAS Philosophy:

Apple does not chase aggressive short-term ROAS.

Typical Benchmarks (Estimated):

- Search Ads ROAS: 4x–6x

- YouTube Brand Lift focus (not direct ROAS)

- Social Ads: 2.5x–4x (remarketing heavy)

Key Insight: Apple prioritizes Brand Lift, Recall & Ecosystem CLV over pure conversion-based ROAS.

Conclusion & Key Learnings

Apple’s marketing performance clearly shows that strong brands are built over time, not bought through aggressive advertising. Throughout the year, Apple stayed consistent with its core philosophy—premium positioning, emotional storytelling, and ecosystem-led growth—while adapting execution based on market maturity and regional needs.

From a marketing point of view, Apple did not aim to win on volume or discounts. Instead, it focused on trust, experience, and long-term customer value, which helped the brand remain resilient even during slower global market conditions.

Key Learnings from Apple’s Marketing Strategy

- Brand Power Reduces Paid Media Dependency

Apple spends a lower percentage of revenue on advertising compared to many global brands, yet achieves higher visibility due to strong brand equity, earned media, and launch-driven PR. - Emotional Storytelling Outperforms Feature Selling

Campaigns like Shot on iPhone and privacy-focused ads prove that human stories, real use-cases, and values create deeper recall than specification-heavy messaging. - Ecosystem Marketing Drives Lifetime Value

Apple markets products not as standalone devices, but as part of a connected ecosystem. This approach increases retention, cross-selling, and long-term revenue per user. - Premium Positioning Can Scale Globally

By avoiding heavy discounting and maintaining consistent brand visuals, Apple protects its premium perception across markets—using tools like EMI and financing instead of price cuts in emerging regions like India. - Performance Marketing Works Best as Support, Not Core

Apple uses performance channels strategically for search, retargeting, and services, while brand campaigns remain the primary growth driver. - Regional Customization with Global Consistency

Apple adapts messaging, media mix, and affordability strategies by region, but never compromises its global brand identity.

Final Marketing Insight

Apple’s annual marketing performance demonstrates that long-term brand building, disciplined advertising, and customer-centric thinking create sustainable competitive advantage. While competitors chase short-term volume and ROAS, Apple focuses on loyalty, trust, and lifetime value, making its marketing strategy one of the strongest and most defensible in the global technology industry.