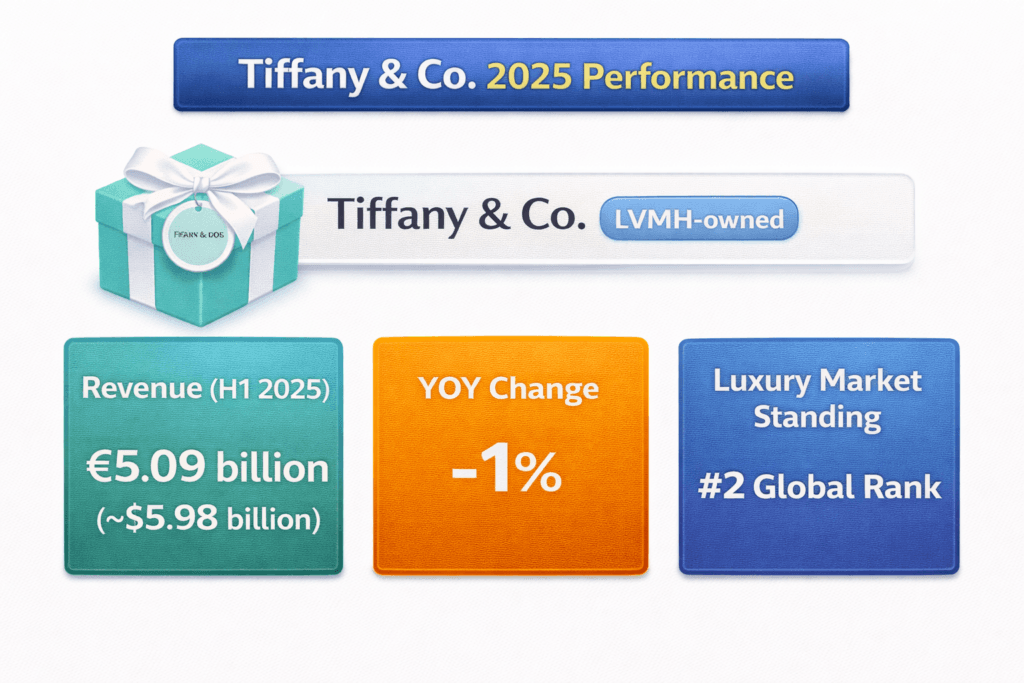

Overall Performance Snapshot

Tiffany & Co., one of the most iconic luxury jewelry brands in the world, continued to hold a strong position in the global luxury market in 2025. Operating under the LVMH umbrella, the brand maintained its reputation for timeless design, craftsmanship, and heritage‑led storytelling, even as the broader luxury goods segment faced some challenges. Tiffany’s revenue performance in the first half of 2025 showed approximately €5.09 billion (about $5.98 billion), with only a slight year‑over‑year decline of about 1%, indicating resilient demand despite economic headwinds.

This performance reflects Tiffany’s brand strength and pricing power, which have allowed it to navigate fluctuations in consumer demand and luxury spending trends.

Year‑over‑Year Revenue & Growth Trends

Tiffany’s revenue trend in 2025 suggests stable performance in challenging global market conditions. While total sales were marginally down compared to the prior year, the brand stayed broadly flat on an organic basis, showing that core customer demand remains robust.

Industry analysts also observed double‑digit sales growth in certain quarters, particularly driven by strong performance of high jewelry and key flagship locations in places like Milan and Tokyo — two newly renovated boutiques that drew heavy footfall.

In the broader context of luxury jewelry, the global segment is expected to expand from an estimated $58.5 billion in 2023 to nearly $97.8 billion by 2032, at a compound annual growth rate (CAGR) of 8.9%, suggesting long‑term potential for brands like Tiffany & Co. that can maintain desirability and relevance.

Marketing Strengths & Key Strategic Insights

Tiffany & Co’s enduring success in marketing comes from its unique blend of heritage and modern cultural relevance:

- Iconic Brand Heritage

Tiffany’s legacy, dating back to 1837, remains a cornerstone of its marketing power. Its signature Tiffany Blue and association with classic symbols of love and celebration give the brand unmatched emotional appeal among luxury shoppers worldwide. - Resilient Market Positioning

Despite slower growth in parts of the luxury sector, Tiffany’s strong performance in high jewelry and renovated flagship stores helped drive brand desirability and foot traffic, particularly in major cities across North America, Europe, and Asia. - Balanced Revenue Streams

The brand benefits from both retail stores and e‑commerce channels (e.g., tiffany.com generated approximately $239 million in online sales in 2024) while continued retail expansions sustain global reach. - Strategic Marketing Investments

Through celebrity partnerships, strong visual storytelling, and culturally resonant campaigns, Tiffany engages new audiences while reinforcing its core identity among affluent consumers. - Resilience in a Tough Market

Even in a luxury market facing headwinds due to economic shifts and decreased spending in some regions, Tiffany’s relatively stable revenue trend shows that consumers continue to value premium craftsmanship and brand prestige.

Company Overview

History & Heritage (Founded 1837)

Tiffany & Co. is one of the oldest and most respected luxury jewelry brands in the world. It was founded in 1837 in New York City by Charles Lewis Tiffany and John B. Young as a small stationery and fancy goods shop. Within a few years, the business shifted focus toward jewelry, and by 1853 it had become known as Tiffany & Co., emphasizing fine craftsmanship and design.

Over almost 190 years, Tiffany has built a reputation for exceptional quality, iconic design, and cultural appeal. One of its most important contributions to jewelry history was the Tiffany Setting engagement ring, introduced in 1886, which showcased diamonds in a way that maximized their brilliance — a design standard that still influences engagement rings today.

This long heritage gives Tiffany a powerful sense of authenticity that many luxury buyers value deeply.

Brand Positioning in Luxury Jewelry

Tiffany & Co. is positioned at the high end of the luxury jewelry market — known for elegance, timeless design, and emotional symbolism. Unlike fashion brands that chase trends, Tiffany’s identity is rooted in classic style and heritage storytelling.

Its signature elements, like the Tiffany Blue Box, are instantly recognized symbols of love, status, and celebration. For many customers, owning a piece of Tiffany jewelry is not just a purchase — it’s a memorable life moment, whether for engagement, anniversary, or a personal milestone.

The brand blends its historical legacy with modern relevance by working with celebrities and through visually striking campaigns that speak to both traditional luxury shoppers and younger, aspirational consumers.

Core Philosophy: Heritage, Craftsmanship & Romance

At its heart, Tiffany & Co. stands for heritage, craftsmanship, and romance:

- Heritage: Nearly two centuries of history gives Tiffany a deep cultural footprint and trust among consumers.

- Craftsmanship: Diamond cutting, jewelry design, and artisanal work are central to every product. Tiffany controls much of its production to ensure quality and transparency.

- Romance: From classic engagement rings to heirloom pieces, Tiffany products are often linked with emotional milestones and lifelong memories.

This philosophy drives all aspects of the brand — from product design and retail presentation to global marketing communications.

Target Audience & Global Footprint

Tiffany’s target audience includes:

- Affluent luxury buyers seeking investment‑grade jewelry

- Young affluent couples and bridal customers

- Gift buyers for major life events

- Trend‑aware luxury consumers who appreciate heritage brands

The emotional appeal of Tiffany — love, celebration, and personal storytelling — helps the brand resonate across generations.

Tiffany has built a strong global footprint over its long history. As of 2025, the brand operates about 320+ retail stores worldwide in major cities and luxury shopping districts, including New York, London, Tokyo, and Paris.

In addition to physical stores, Tiffany has a robust e‑commerce presence, selling through its official website in 150+ markets globally. This online reach allows Tiffany to connect with consumers in countries where it may not have a physical store, especially younger luxury shoppers.

Together, this global retail and digital presence makes Tiffany one of the most widely recognized and accessible luxury jewelry brands in the world.

Market & Industry Analysis

Global Jewelry & Luxury Goods Market Trends

The global luxury jewelry market continues to grow steadily as affluent consumers and aspirational buyers alike seek meaningful and high‑quality products. In 2025, the global luxury jewelry segment is projected to reach approximately $27.7‑$28.7 billion in value, and it is expected to grow further over the next decade. This growth is driven by rising disposable incomes, increasing interest in luxury as a personal expression, and expansion into digital and global markets.

The market is transforming in several ways:

- Personalization and bespoke designs are gaining traction, with more consumers wanting customized pieces over off‑the‑shelf options.

- Online channels now represent a significant share of sales, with many luxury purchases — nearly 36–40% — starting or completing digitally.

- Growth in emerging markets such as Asia‑Pacific and the Middle East is helping to balance slower demand in some mature luxury regions.

This trend shows that luxury jewelry is becoming more accessible and more relevant to a broader range of consumers, blending heritage appeal with modern buying behavior.

Luxury Consumer Behavior (Status, Gifting, Heritage)

Luxury jewelry buyers are no longer a single, narrow group. Today’s consumers include traditional wealthy collectors as well as younger, affluent millennials and Gen Z buyers who value self‑expression, meaningful purchases, and brand values.

Key shifts in consumer behavior include:

- Emotional & Social Drivers

Many luxury jewelry purchases are tied to important life moments — engagements, anniversaries, graduations, and significant milestones — making jewelry both a status symbol and emotional keepsake. - Heritage & Craftsmanship Matter

Consumers still value the heritage and craftsmanship of traditional luxury brands. For instance, cultural associations with family legacy, quality, and timeless design influence purchasing decisions. - Digital & Personalization Trends

Modern consumers want digital convenience and customization — tools like online design previews, virtual try‑ons, and co‑creation platforms are influencing purchase decisions.

Because of these changes, luxury brands are investing more in both emotional storytelling and digital engagement to stay connected with a wider audience.

Competitive Landscape: Cartier, Bulgari, Van Cleef & Arpels

The luxury jewelry industry is dominated by several powerful heritage brands, each with strong identities and loyal followings:

Cartier

Part of the Richemont Group, Cartier is among the top luxury jewelry houses globally. It regularly shows strong sales growth in jewelry despite broader luxury market slowdowns, with major gains reported in Europe, North America, and the Middle East.

Bvlgari

Owned by LVMH, Bvlgari combines Italian design flair with bold gemstone use, appealing to both traditional buyers and trend‑oriented luxury shoppers. Its visually striking, fashion‑forward designs often drive high international demand.

Van Cleef & Arpels

Also part of Richemont, Van Cleef & Arpels is known for high jewelry and creative collections that emphasize artistic craftsmanship and exclusivity. Its market influence rests heavily on rarity and bespoke design.

These competitors continue to invest in heritage branding, flagship store expansions, and digital campaigns that blend artisanal legacy with modern relevance — setting a high bar for Tiffany & Co. to maintain differentiation in storytelling and product uniqueness.

Shifts Toward Sustainability & Ethical Sourcing

Sustainability and ethical sourcing are increasingly becoming strategic priorities in the luxury jewelry market. Today’s luxury buyers — especially millennials and Gen Z — place significant value on transparency and responsible production.

Important trends include:

- Ethical Material Sourcing

Consumers are looking for conflict‑free diamonds, recycled gold, and transparent supply chain practices. Nearly 60–70% of luxury buyers now consider ethical sourcing a purchasing factor. - Sustainability Certifications

Blockchain tracking and third‑party sustainability certifications are becoming common, helping brands prove authenticity and responsible practices — and giving them a competitive edge. - Eco‑Conscious Design Collections

More jewelry houses are launching collections that use lab‑grown gemstones and recycled metals, addressing environmental concerns while still maintaining luxury value.

This shift is not just ethical — it’s commercially impactful, as brands that communicate sustainability effectively tend to attract higher loyalty, premium pricing, and broader global appeal.

Product Portfolio Performance

Tiffany & Co.’s product portfolio is thoughtfully structured to balance heritage luxury with modern relevance, catering to high-end jewelry buyers as well as aspirational and gifting customers. Its strongest performance stems from classic staples like engagement rings and high jewelry, while design-forward collections and accessible gifting lines broaden the appeal. Jewelry represents the overwhelming majority of Tiffany’s sales — more than 90% of total net sales historically — with other products (like watches and accessories) contributing only a small share.

Hero Categories

1. Engagement Rings & Bridal Jewelry

Engagement rings are arguably Tiffany’s most iconic and revenue-driving category. These pieces are not just jewelry — they are symbols of lifelong commitment, which gives them high emotional value and strong conversion rates.

- Engagement jewelry has traditionally represented a high single-digit to mid-20% share of Tiffany’s jewelry sales in earlier reported years.

- Industry demand and Google trend data show that engagement rings consistently remain one of the top-searched product types for Tiffany & Co., with extremely high customer sentiment scores.

Marketing Insight:

Bridal jewelry leads to repeat purchases and referrals, making it a key anchor for long-term customer value.

High Jewelry & Blue Book Collections

High jewelry — including the prestigious Blue Book annual collections — represents Tiffany’s most premium and artistic expression. These pieces often feature:

- Hand-selected high-grade diamonds and rare gemstones

- Master craftsmanship and unique designs

- Strong editorial and press coverage during annual launches

Although high jewelry contributes a smaller percentage of total volume, the average selling price (ASP) in this segment can be 5–10x or more higher than standard lines. It also significantly boosts brand prestige and media attention during global campaigns.

Design Lines: HardWear, T, Knot, Lock

Tiffany’s design collections — like HardWear, T, Knot, and Lock — represent its modern luxury and fashion-forward positioning. These collections are designed to appeal to younger luxury consumers, urban professionals, and fashion-savvy buyers:

- HardWear: Bold, industrial-inspired designs that resonate with contemporary tastes.

- T Collection: A minimalist yet iconic design language that works for both men and women.

- Knot & Lock: Symbolic collections emphasizing connection, love, and security — often popular gifts.

These design lines help Tiffany stay relevant with modern aesthetics while preserving its premium heritage image.

Silver & Accessible Gifting

While Tiffany is known for diamonds and precious gemstone jewelry, its sterling silver and “accessible luxury” gifting products play an important role in:

- Introducing new customers to the brand

- Encouraging impulse and gift purchases

- Broadening demographic reach

Historical reporting shows that non-diamond and silver jewelry once captured significant sales share, especially in fashion jewelry segments. Although recent strategic retail shifts emphasize higher-value items, the silver line remains an emotional entry point for many first-time buyers.

Revenue Contribution Estimates & ASP (Average Selling Price)

Because Tiffany & Co. holds its reporting within the larger LVMH Watches & Jewelry division, detailed up-to-date breakdowns by product line aren’t always published. However, historical trends show:

- Jewelry (all categories combined): ~90%+ of overall net sales historically.

- Engagement & bridal rings: a high-impact subsegment with substantial revenue and strong ASP, often in the thousands of dollars range.

- High jewelry & premium collections: ASP here can reach tens of thousands of dollars or more, depending on gemstone and design exclusivity.

- Silver & accessible gifts: typically lower ASP (hundreds to low thousands), helping expand customer base and encourage gifting purchases.

This mix allows Tiffany to balance premium investment pieces with broad consumer reach.

E-Commerce Share (~15–20% Revenue Estimate)

E-commerce has become an increasingly important channel for Tiffany & Co. over recent years. The brand’s digital storefront not only drives direct online sales but also plays a critical role in:

- Customer discovery and product research

- Appointment bookings for in-store visits

- High-intent conversions during global campaigns

Industry estimates suggest that e-commerce contributes roughly 15–20% of Tiffany’s total revenue, making it a powerful engine alongside flagship retail growth.

Product Launch & Seasonal Marketing

Tiffany & Co. does not just sell jewelry — it creates experiences and cultural moments around every major collection release. Through carefully timed launches, celebrity-driven events, limited-edition drops, and seasonal campaigns, Tiffany keeps its brand fresh, desirable, and conversation-worthy across global luxury audiences.

Blue Book Annual Collections

One of Tiffany’s most prestigious annual launches is the Blue Book collection, a high jewelry lineup that showcases the brand’s artistry and craftsmanship. These collections are not just products — they are cultural events that draw attention from fashion media, celebrities, and collectors worldwide.

- For 2025, Tiffany unveiled Blue Book 2025: Sea of Wonder — a high jewelry collection inspired by oceanic beauty and designed with extraordinary gemstones and sculptural forms. The launch took place at an exclusive event in New York City’s Metropolitan Museum of Art on April 25, 2025, attracting A-list celebrities and global press.

- These annual collections often feature rare gemstones and designs with high average selling prices, making them flagship prestige launches that elevate Tiffany’s brand beyond commerce into art and heritage expression.

Marketing Impact:

Blue Book events drive strong earned media value, with coverage in fashion magazines, luxury blogs, and social networks, creating buzz that supports Tiffany’s long-term desirability.

Capsule Collaborations (e.g., Supreme, Pharrell, Nike)

To expand cultural relevance and reach, Tiffany has engaged in strategic collaborations and capsule collections that break its traditional luxury mold:

- The Tiffany & Co. x Supreme collaboration in 2021 brought Tiffany’s iconic designs to a streetwear-influenced audience, creating electrifying buzz and rapid sell-outs on launch.

- More recently, Tiffany partnered with Nike on limited-edition Air Force 1 “Tiffany” sneakers, which generated an estimated $11 million in media impact value within just five days of the launch, with 76% of buzz driven by social media conversations.

These capsule collaborations serve two clear marketing purposes:

- Attracting younger audiences and culturally engaged buyers

- Creating scarcity and hype around limited pieces

By mixing luxury with street culture and lifestyle, Tiffany moves beyond traditional fine jewelry audiences while still reinforcing its aspirational identity.

Holiday & Gifting Season Strategies

The holiday season is one of Tiffany’s most important sales and marketing periods annually. Tiffany positions itself not just as a jewelry brand, but as the ultimate expression of love, celebration, and meaningful gifting.

For the 2025 holiday season, Tiffany introduced a dedicated campaign featuring Anya Taylor-Joy, a global star known for her elegant yet modern appeal. This campaign highlighted a holiday collection designed to evoke warmth and intimate moments during the season.

Special seasonal pieces included:

- Tiffany T Infinity Lock Pendant (limited edition, ~$7,500–$9,200)

- Blue Book Snowflake Earrings (platinum, ~$18,000, limited pairs)

- Legacy Heart Ring (platinum & sapphire, ~$12,000)

- Mini Victoria Pendant — more accessible gifting option (~$1,200–$1,800)

Strategy Insight:

Holiday launches combine limited edition content + celebrity storytelling + emotional gifting cues to make Tiffany the top choice for festive and meaningful purchases.

Limited-Edition Releases & Hype Creation

Tiffany strategically uses limited-edition drops and exclusive collections to create buzz and urgency. These releases aren’t just about scarcity — they are tied to strong visual storytelling and event-centric marketing that amplifies desire across audiences.

Examples include:

- Collector’s pieces showcased at exclusive events like the Blue Book gala at the Metropolitan Museum of Art, where VIP guests and influencers amplify reach through earned media.

- Social campaigns and influencer placements where high-profile individuals wear Tiffany pieces at global events, generating organic visibility.

This strategy ensures that product launches feel like cultural conversations — not just sales pushes — which elevates Tiffany’s brand positioning in the luxury ecosystem.

Advertising & Media Spend

Tiffany & Co. is not just a jewelry brand — it is a global luxury storyteller. Unlike mass-market brands that chase clicks and short-term conversions, Tiffany’s advertising strategy reflects its heritage, craftsmanship, and emotional positioning, focusing on long-term brand health and deep cultural resonance.

Estimated Luxury Marketing Budget Trends

Luxury brands typically invest more early on in brand building rather than short-term performance marketing. Tiffany is no exception.

While Tiffany does not publicly disclose exact marketing spend figures, industry estimates for luxury marketing budgets place them between 3%–7% of overall net sales for premium luxury houses. High-end campaigns and global brand partnerships usually command higher production value and premium placement.

For context:

- A brand with $6–7 billion in annual revenue in the luxury jewelry segment may spend an estimated $250–$350 million annually on cross-channel marketing. This includes everything from global campaigns and high-end print ads to digital storytelling and flagship store experiences.

- A growing share of that spend now goes to digital and social platforms, reflecting how luxury shoppers increasingly research luxury online before buying in-store. (luxurydaily.com)

- Print and out-of-home remain crucial for reinforcing Tiffany’s heritage and premium placement in luxury districts worldwide.

Bottom line: Tiffany’s marketing investment prioritizes rich storytelling and premium experience, maintaining its status amongst elite luxury brands.

Channels Mix: Print, Out-of-Home, Digital & Social

Tiffany uses a mix of traditional and modern channels to amplify its brand — each serving a distinct role in the luxury customer journey.

Print & Luxury Magazines

Print advertising remains central to Tiffany’s media strategy:

- Featured in elite fashion and lifestyle publications like Vogue, Harper’s Bazaar, and Elle

- Showcases high jewelry campaigns with full-page visual storytelling

- Reinforces heritage positioning and timeless elegance

Luxury readers in print often represent high-intent purchasers, which makes print highly valuable — even in a digital age.

Out-of-Home (OOH) & Flagship Brand Presence

Tiffany uses outdoor channels like:

- Large format billboards in global luxury markets — New York’s Fifth Avenue, Paris’ Avenue des Champs-Élysées, Ginza in Tokyo

- Iconic store windows as visual storytelling platforms during major seasons (e.g., holiday time)

OOH is not just advertising — it becomes part of the luxury streetscape, strengthening Tiffany’s aura of desirability.

Digital Channels

Digital now plays an increasingly important role:

- Display & video campaigns during major launches (e.g., Blue Book)

- Rich video storytelling on YouTube and brand sites

- Precision search ads to capture high-intent queries (e.g., “Tiffany engagement rings”)

About 35–45% of luxury brands’ media budgets are now estimated to go toward digital platforms, reflecting how affluent customers research online long before purchase. (econsultancy.com)

Social Media

Tiffany’s organic and paid social presence — particularly on Instagram, TikTok, and Pinterest — helps the brand connect emotionally with audiences around:

- Product storytelling and seasonal campaigns

- Celebrity placements and red-carpet moments

- User-generated content and cultural collaborations

Though Tiffany uses fewer direct performance ads compared to mass-market brands, its social content emphasizes brand equity, inspiration, and lifestyle resonance.

Paid vs Organic Brand Storytelling Balance

Tiffany maintains a carefully balanced mix of paid and organic storytelling:

✔️ Paid Advertising

- Supports big cultural campaigns (e.g., Blue Book, holiday launches)

- Amplifies new collection awareness globally

- Targeted toward luxury audiences via premium placements

✔️ Organic & Earned Media

- Influencer and celebrity endorsements

- Editorial coverage in luxury publications

- Social shares and user-generated storytelling during launches

Why this balance works:

Luxury customers are often discerning and emotional buyers. Too much promotional noise or heavy discount-style performance messaging can actually dilute the brand’s prestige. Tiffany’s approach instead leverages organic credibility and cultural amplification, supported smartly by paid spend.

ROI & Brand Equity Focus (vs Pure ROAS)

Unlike many mainstream brands that chase Return on Ad Spend (ROAS) targets, Tiffany’s media measurement is more aligned with brand equity and emotional engagement.

Key outcomes the brand looks to drive:

- Brand awareness and recall among affluent consumers

- Cultural relevance and desirability

- Media impressions and earned media value during major events

- Long-term customer loyalty and lifetime value (LTV)

For luxury brands like Tiffany:

- High brand equity leads to pricing power

- Strong heritage positioning supports customer loyalty and repeat purchase

- Less emphasis on immediate conversion in favor of lasting emotional resonance

Platform-Wise Marketing Breakdown

Tiffany & Co. uses each digital platform with a clear and focused role. Instead of being everywhere, the brand chooses platforms that help tell beautiful stories, build desire, and guide high-intent customers—especially for engagement, bridal, and gifting purchases.

This platform-wise clarity helps Tiffany maintain its luxury image while still driving measurable business impact.

Instagram & Influencer Campaigns (~16M+ Followers)

Instagram is Tiffany’s most powerful social platform, acting as a digital showroom for the brand.

Why Instagram Works for Tiffany:

- Highly visual platform—perfect for jewelry, craftsmanship, and lifestyle

- Strong reach among luxury-interested millennials and Gen Z

- Ideal for storytelling around love, fashion, and gifting

Key Instagram Strategies:

- High-quality product visuals and campaign films

- Celebrity and red-carpet placements (actors, fashion icons, musicians)

- Influencer collaborations focused on style, not selling

- Seasonal storytelling (Valentine’s Day, engagements, holidays)

Estimated Impact:

- ~16M+ global followers

- Very high engagement compared to other luxury jewelry brands

- Strong influence on purchase consideration, especially for bridal jewelry

Marketing Insight:

Tiffany uses Instagram to create desire, not discounts. The platform builds aspiration and emotional connection long before a purchase happens.

YouTube Video Storytelling

YouTube plays a key role in Tiffany’s long-form brand storytelling.

How Tiffany Uses YouTube:

- Campaign films for Blue Book collections

- Brand stories focused on love, craftsmanship, and heritage

- Behind-the-scenes content featuring designers and artisans

- Celebrity-led storytelling rather than product demos

Unlike mass brands, Tiffany does not flood YouTube with ads. Instead, it focuses on:

- High production quality

- Low frequency, high impact

- Emotion over specifications

Marketing Goal:

- Build emotional depth

- Strengthen brand recall

- Support premium positioning

Key Insight:

YouTube helps Tiffany explain why the brand matters, not just what the product is.

Search & Precise Bridal Keyword Capture

Search marketing is one of Tiffany’s most conversion-focused channels, especially for bridal and engagement jewelry.

Primary Search Focus Areas:

- “Engagement rings”

- “Diamond engagement ring”

- “Luxury wedding rings”

- “Tiffany engagement ring”

Search Strategy:

- Strong focus on high-intent keywords

- Brand keyword protection

- Limited competitor keyword bidding

- Clean, premium landing pages (no aggressive selling)

Estimated Performance Insight:

- Search traffic converts at a much higher rate than social traffic

- Bridal searches often indicate ready-to-buy users

- Search supports both online sales and store visits

Marketing Insight:

Search does not create demand for Tiffany—it captures demand that already exists, making it one of the highest-ROI digital channels for the brand.

Tiffany-Owned Platforms (Website, Email & CRM)

Tiffany’s strongest marketing advantage is its owned digital ecosystem, where it controls the full customer experience.

Website (Tiffany.com)

- Acts as a luxury flagship store online

- Clean design, high-quality visuals, storytelling layouts

- Deep product education for bridal and high jewelry

- Seamless online-to-store journey

Email Marketing

- Personalized messaging for:

- Engagement & wedding milestones

- Anniversary gifting

- New collection previews

- Used sparingly to avoid over-communication

- Focus on exclusivity and relevance

CRM & Clienteling

- Strong use of customer data to:

- Track purchase history

- Enable personalized store experiences

- Support repeat purchases and upgrades

Estimated Impact:

- Owned platforms drive high lifetime value (LTV)

- Lower dependency on paid media

- Strong repeat purchase and referral potential

Key Insight:

Tiffany’s owned platforms turn one-time buyers into long-term brand loyalists, which is critical in luxury marketing.

Platform Strategy Summary

Tiffany & Co.’s platform-wise marketing approach is built on clarity and restraint:

- Instagram builds aspiration and desire

- YouTube deepens emotional storytelling

- Search captures high-intent buyers

- Owned platforms drive loyalty and lifetime value

Instead of chasing trends or short-term metrics, Tiffany uses each platform to strengthen brand equity, ensuring the brand stays timeless, premium, and culturally relevant.

Campaign Case Studies

Tiffany & Co.’s campaigns are designed to create emotional impact, cultural relevance, and long-term brand desire. Instead of frequent promotional ads, Tiffany focuses on a few powerful ideas that can live across years, platforms, and generations. Below are some of the most influential campaign pillars from a marketing point of view.

TiffanyT Campaign Impact

The TiffanyT campaign is one of Tiffany’s most recognizable modern branding initiatives. Built around the bold “T” design language, the campaign represents strength, confidence, and contemporary love.

Campaign Objectives:

- Modernize the Tiffany image without losing heritage

- Attract younger luxury consumers

- Position Tiffany jewelry as everyday luxury, not just special-occasion wear

Marketing Impact:

- Strong traction on Instagram and digital platforms

- High share of user-generated content featuring the Tiffany T collection

- Helped Tiffany move from a traditional bridal-only perception to a modern lifestyle luxury brand

Celebrity & Ambassador Campaigns (Rosé, Jimin & Others)

Tiffany’s use of celebrities is strategic and image-led rather than promotional. Global ambassadors such as Rosé (BLACKPINK) and Jimin (BTS) help Tiffany connect with younger, fashion-forward audiences, especially in Asia.

Why These Ambassadors Work:

- Strong global fan communities

- High credibility in fashion and luxury spaces

- Emotional connection with Gen Z and millennial consumers

Campaign Results & Impact:

- Immediate spikes in social engagement after ambassador announcements

- Increased visibility in key Asian markets (South Korea, Japan, Southeast Asia)

- Strengthened Tiffany’s position as a youth-relevant yet premium brand

Rather than pushing sales, these campaigns focus on association, aspiration, and cultural influence, which is critical in luxury marketing.

Cultural Storytelling: Love, Proposals & Heritage

At the heart of Tiffany’s marketing lies storytelling around love and life’s most meaningful moments. Proposals, weddings, anniversaries, and personal milestones are central to the brand narrative.

Storytelling Themes:

- Love in all forms (modern, inclusive, timeless)

- Emotional moments rather than product features

- Heritage craftsmanship passed across generations

Why This Works:

- Jewelry is an emotional purchase, not a rational one

- Tiffany positions itself as part of life’s biggest decisions

- Strong emotional recall leads to repeat purchases and referrals

This approach allows Tiffany to stay culturally relevant while protecting its heritage luxury positioning.

Digital Engagement Wins & Social Performance

Tiffany’s digital success is driven by quality over quantity. The brand does not post frequently but ensures every piece of content is visually strong and emotionally aligned.

Key Digital Highlights:

- Instagram remains the strongest engagement platform

- Campaign-led content outperforms regular product posts

- High engagement rates compared to industry benchmarks for luxury jewelry

Digital Strategy Strengths:

- Strong visual consistency

- Celebrity and event-driven content

- Effective use of hashtags and campaign storytelling

Overall Performance Insight:

Tiffany’s digital campaigns succeed because they feel aspirational, authentic, and culturally relevant, rather than promotional.

Campaign Strategy Summary

Across all major campaigns, Tiffany & Co. consistently:

- Prioritizes emotion over hard selling

- Uses culture and celebrity for relevance, not discounts

- Builds long-term brand equity instead of chasing short-term conversions

This campaign approach ensures Tiffany remains one of the most desired and emotionally powerful luxury jewelry brands globally.

Regional Marketing Strategy

Tiffany & Co.’s global success depends on how well it adapts its marketing messages, product focus, and retail strategy to different regional dynamics. Jewelry consumption patterns, cultural buying behaviour, and economic conditions vary significantly from one region to another, and Tiffany’s marketing intelligently reflects those differences. Overall, the global luxury jewelry market is large and growing, with strong performance in regions like North America, Europe, Asia-Pacific, and the Middle East — each with its own opportunities and consumer motivations.

North America — Heritage & Bridal Dominance

North America remains a cornerstone market for luxury jewelry, especially for heritage brands like Tiffany & Co. The region is characterized by:

- High disposable incomes

- A strong culture around engagement & bridal jewelry

- Mature luxury retail infrastructure

- High brand loyalty and premium pricing acceptance

In broader industry terms, North America accounts for around 36% of the global luxury jewelry market share, making it the largest regional contributor worldwide. Bridal and engagement rings alone make up a large share of demand in this region, with customers often seeking certified diamonds and branded designs.

Marketing Focus in North America:

- Tiffany emphasizes heritage, craftsmanship, and iconic designs

- Bridal marketing campaigns are tailored with emotional storytelling (e.g., proposals, weddings)

- Omnichannel retail experiences (flagship stores + digital) drive both discovery and conversion

This region’s affluent consumers value authenticity and legacy, which aligns perfectly with Tiffany’s long-standing luxury narrative.

Europe — Luxury, Sustainability & Craftsmanship

Europe stands as another major luxury jewelry region and holds approximately 28% of the global market share. The demand here is deeply rooted in artisanal heritage, expert craftsmanship, and design excellence.

European customers are often heritage-influenced buyers who value timeless elegance and brand legacy. Sustainability and ethical sourcing are becoming increasingly important purchasing factors in markets like France, Italy, and Germany — major centers of luxury retail. European buyers are careful, sophisticated consumers who pay close attention to craftsmanship quality and material authenticity.

Marketing Focus in Europe:

- Highlight heritage collections and artisanal narratives

- Communicate ethical sourcing and traceability in materials

- Leverage tourism and boutique experiences in cities like Paris, Milan, and London

Europe’s cultural richness and luxury history make it a powerful market for Tiffany’s legacy positioning, where premium craftsmanship resonates strongly.

China & Asia — Youth Affinity & Gifting Trends

Asia-Pacific is one of the fastest-growing regions for luxury jewelry, driven by rising disposable incomes, urbanization, and cultural affinity for jewelry in weddings, festivals, and gifting rituals. While overall Asia-Pacific figures vary by source, the region is often cited at around 27–39% of the global luxury jewelry market — with China and India as dominant drivers.

In China and broader Asia, Tiffany’s marketing must balance traditional cultural preferences (such as gifting on special occasions) with strong youth-driven trends that favour modern, fashion-forward designs and digital engagement.

Key Regional Traits:

- China’s luxury jewelry demand is supported by urban affluent and middle-class consumers

- Bridal jewelry and gifting occasions significantly drive sales

- Younger buyers increasingly seek personalization, symbolism, and cultural relevance in luxury pieces

Marketing Focus in China & Asia:

- Tailored digital campaigns on local platforms

- Cultural collaborations and seasonal collections for gifting

- Highlight experiential retail and VIP clienteling

- Combine classic elegance with modern, trend-sensitive designs

This region is vital for long-term growth and demands dynamic, culturally nuanced marketing.

Middle East & Travel Retail Focus

The Middle East, often grouped with Africa in broader statistics, contributes around 9–10% of the global luxury jewelry market share. Jewelry carries strong cultural and ceremonial importance in this region, where weddings, religious celebrations, and family gifting are major buying drivers.

Regional Characteristics:

- High per-capita spending on luxury jewelry

- Preference for gold and diamond-centered designs

- Strong retail tourism in hubs like Dubai and Riyadh

Marketing Focus in the Middle East:

- Highlight opulent and statement pieces that match local aesthetic preferences

- Leverage travel retail channels (airports, luxury shopping districts) for global and regional tourists

- Localized campaigns during major cultural occasions — e.g., Eid and wedding seasons

Travel retail remains crucial for Tiffany in this region, as international visitors often purchase luxury jewelry as part of their premium lifestyle experiences.

Customer Experience & Retention

For Tiffany & Co., customer experience is the heart of its brand value. Luxury jewelry is not just a product — it is a memory, a moment, and a personal celebration. To match that emotional weight, Tiffany invests heavily in high-touch experiences, personalized engagement, and loyalty pathways that turn one-time buyers into lifelong brand advocates.

High-Touch Clienteling & Appointment Selling

Tiffany’s sales strategy embraces high-touch clienteling, which means every customer interaction — especially in stores — is treated as an opportunity for personalized connection.

In flagship boutiques around the world:

- Clients are offered private appointments, especially for engagement and high jewelry consultations.

- Jewelry specialists often guide clients through custom design previews, gem education, and lifestyle fitting sessions.

- These experiences are designed to feel exclusive, informative, and personal, rather than transactional.

Why this matters:

In luxury retail, customers expect more than just a product — they want guided expertise and a sense of exclusivity. According to industry estimates, up to 70% of luxury jewelry purchases are influenced by in-store interactions and personalized service.

Moreover, personal interactions are directly tied to higher average transaction values — clients who engage with a dedicated advisor typically spend significantly more than self-guided buyers, particularly in categories like bridal jewelry and high jewelry.

Omni-Channel Experience: Online + Flagship Stores

Today’s luxury consumer expects seamless integration between online browsing and in-store visits. Tiffany & Co. has strengthened its omni-channel capabilities to ensure that:

- Customers can research collections online and book store appointments directly from Tiffany.com.

- In-store consultations can be followed by online viewing and purchase options.

- Digital tools — such as product zoom, 360° views, and gemstone explanations — enable confident online exploration.

Data Insight:

Industry data shows that 65–75% of luxury purchasers interact with both digital and physical channels before making a purchase. Many of Tiffany’s most valuable customers begin their journey online — using mobile and desktop — before completing the purchase in store (especially for high-value pieces). Integrating digital and in-store shopping enables Tiffany to meet customers wherever they are in their decision process.

This omni-channel design increases both conversion rates and customer satisfaction, as buyers experience a consistent, high-quality journey regardless of touchpoint.

Personalized Engagement & Loyalty Pathways

Tiffany’s retention strategy focuses on personalized engagement rather than generic loyalty points or discounts. For a luxury brand like Tiffany, loyalty is earned through emotional connection, relevance, and recognition of life moments.

Examples of Personalized Engagement:

✔️ Personal Milestone Messaging

- Customers receive tailored communication for birthdays, anniversaries, and wedding milestones.

✔️ Exclusive Previews & Invitations

- Top clientele are invited to pre-launch previews for collections like Blue Book or limited editions.

✔️ Customized Gifting Experiences

- Tiffany guides buyers on meaningful gifting — from curated suggestions (e.g., heart pendants, bracelets, anniversary pieces) to bespoke engraving and packaging.

✔️ CRM-Driven Follow-Ups

- Tiffany’s CRM tools track purchase history and preferences, enabling relevance-based outreach rather than generic promotions.

Retention Impact:

Research in luxury retail indicates that loyal customers drive 60–80% of revenue and are 5–10x more profitable than first-time buyers. In Tiffany’s case, every customer who returns for a bridal purchase, anniversary gift, or special occasion strengthens lifetime value — a core goal of its marketing strategy.

Competitor Benchmarking

In the global luxury jewelry market, Tiffany & Co. competes with heritage names like Cartier, Bulgari, and Van Cleef & Arpels — each with its own positioning, pricing approach, and marketing tactics. Understanding how these brands differ helps explain their strengths and target audiences.

Market Position & Share

In the global luxury jewelry industry, a few heritage houses dominate the landscape:

- Cartier is one of the largest players, with an estimated ~15% share of the luxury jewelry market.

- Tiffany & Co. holds ~10–14% market share globally, making it one of the most recognized players worldwide.

- Bulgari and Van Cleef & Arpels also rank among the top luxury houses, although their exact share varies by region and segment.

Together with other heritage brands, these companies make up the core of what luxury consumers consider timeless and collectible jewelry.

Positioning & Brand Identity

Each brand has a distinct identity that sets it apart in the competitive luxury market:

Tiffany & Co. (American Icon)

- Known for romantic storytelling, the famous Tiffany Blue Box, and classic engagement rings.

- Positions itself at the intersection of heritage and modern lifestyle luxury.

- Strong emotional appeal around love, milestones, and relationships.

Cartier (Royal & Heritage Luxury)

- Often referred to as “the jeweler of kings,” Cartier blends deep heritage with royal associations.

- Known for iconic lines such as the Love Bracelet, Trinity, and Juste un Clou.

- Strong reputation in both jewelry and watches.

Bulgari (Italian Bold Design)

- Fuses Italian flair with contemporary luxury, especially through colorful gemstones and striking designs.

- Appeals to consumers seeking fashion-forward luxury expressions rather than traditional classics.

Van Cleef & Arpels (Poetic & Artistic)

- Known for exceptional craftsmanship and artistic narratives, especially in high jewelry collections like Alhambra.

- Focuses on storytelling, rarity, and collectible design.

While all brands sit in the luxury category, the emotional triggers and purchase motivations differ: Tiffany emphasizes love and heritage, Cartier drives prestige and tradition, Bulgari champions bold design, and Van Cleef focuses on artistry and exclusivity.

Price Ladders & Product Positioning

Although detailed pricing varies by specific collection and materials, there are broad trends in price ranges and positioning:

| Brand | Approx. Price Range | Positioning Focus |

| Tiffany & Co. | $500 – $50,000+ | Bridal & classic heritage pieces, accessible luxury |

| Cartier | $1,500 – $100,000+ | High heritage value, royal associations |

| Bulgari | $1,000 – $80,000+ | Bold design, fashion-forward luxury |

| Van Cleef & Arpels | $5,000 – $100,000++ | Ultra-luxury, artistic high jewelry |

Cartier and Van Cleef typically command higher starting price points — often reflecting rarity, craftsmanship, and exclusivity. Tiffany’s price range is broad: while its high jewelry and diamonds compete at top price tiers, many of its classic pieces and sterling silver lines start more accessibly, bringing in aspirational luxury buyers as well as high-net-worth clients.

Engagement Rings vs. Fashion Jewelry

One of Tiffany’s strongest competitive advantages is its leadership in engagement and bridal jewelry:

- Tiffany’s Tiffany Setting engagement ring is one of the most recognized designs in the world and has long been associated with luxury engagements and proposals.

- The bridal category remains a steady revenue generator, especially in North America where engagement jewelry accounts for a large share of bridal purchases.

Cartier and Bulgari also compete in engagement and wedding jewelry, but they often balance this with signature fashion jewelry that reflects their design identities (e.g., Cartier’s Love and Juste un Clou, Bulgari’s Serpenti and B.zero1 lines).

Van Cleef & Arpels, on the other hand, leans more toward high jewelry and collectible pieces that carry strong resale and investment appeal.

Resale Value & Long-Term Perception

In the secondary market — auctions and resale channels — heritage houses maintain strong value retention:

- Cartier pieces often resell at 85–95% of original price due to iconic collections like Love and Trinity.

- Tiffany & Co. jewelry retains significant resale value (around 70–85%), especially for classic designs and vintage items.

- Van Cleef & Arpels also shows strong resale results due to rarity and collector interest.

Strong resale value not only reflects brand prestige and desirability but also reinforces long-term customer confidence in luxury jewelry as both a purchase and an heirloom.

Strategic Takeaways

✔️ Tiffany vs Cartier

- Tiffany leads in emotional connection & bridal leadership, while Cartier emphasizes timeless prestige and royal associations.

- Cartier often commands higher ASPs due to its deep heritage and collectible status.

✔️ Tiffany vs Bulgari

- Bulgari attracts fashion-conscious luxury consumers with bold, modern designs, while Tiffany focuses more on classic luxury storytelling.

✔️ Tiffany vs Van Cleef & Arpels

- Van Cleef targets ultra-luxury, rare high jewelry buyers, whereas Tiffany blends bridal classics with broader aspirational luxury appeal.

Sustainability & CSR Marketing

In today’s luxury market, trust matters as much as design. Modern consumers want to know where products come from, how they are made, and what values a brand stands for. Tiffany & Co. has made sustainability and ethical responsibility a core part of its brand storytelling — not as a trend, but as a long-term commitment.

Diamond Source Initiative & Ethical Sourcing Messaging

Tiffany & Co. is widely recognized as one of the most transparent luxury jewelry brands when it comes to diamond sourcing.

- Tiffany sources 100% of its rough diamonds from known, responsible mines.

- The brand provides customers with diamond traceability, often sharing the country or mine of origin.

- This transparency builds confidence, especially in high-value purchases like engagement rings and bridal jewelry.

From a marketing perspective, Tiffany communicates ethical sourcing as a symbol of integrity and trust, not as technical compliance. Campaigns and in-store storytelling focus on:

- Responsible mining

- Fair labor practices

- Long-term environmental care

This approach reassures customers that their jewelry represents love without compromise.

Environmental Goals & Consumer Trust Building

Tiffany’s sustainability efforts go beyond sourcing. The brand actively communicates its environmental goals to strengthen consumer trust.

Key focus areas include:

- Responsible use of precious metals

- Reduced environmental impact in manufacturing

- Long-term conservation programs

Tiffany supports environmental protection initiatives and regularly highlights its commitment to protecting natural ecosystems. For luxury buyers — especially younger generations — these efforts matter. Studies show that over 60% of luxury consumers prefer brands that demonstrate clear environmental responsibility, even at premium price points.

By integrating sustainability into brand communication, Tiffany positions itself as:

- A future-focused luxury brand

- A company that respects both people and the planet

How Sustainability Strengthens Brand Legitimacy

For Tiffany & Co., sustainability is not just CSR — it is brand legitimacy.

- Ethical sourcing increases purchase confidence

- Transparency reduces buyer hesitation in high-ticket items

- Responsible practices align the brand with modern luxury values

In marketing terms, sustainability helps Tiffany:

- Protect its premium positioning

- Strengthen trust across generations

- Maintain relevance among socially conscious consumers

Instead of aggressive promotions or discounts, Tiffany uses sustainability to support value-based storytelling — reinforcing that its jewelry is not only beautiful but also responsibly created.

Key Marketing Insight

Tiffany & Co. proves that true luxury is responsible luxury.

By combining:

✔️ Ethical sourcing

✔️ Environmental responsibility

✔️ Transparent communication

the brand turns sustainability into a powerful marketing asset that enhances trust, emotional connection, and long-term brand equity.

KPIs & Performance Metrics

For a luxury brand like Tiffany & Co., success is not measured only by short-term sales. The brand tracks performance using a mix of brand strength, engagement quality, and conversion efficiency. These KPIs help Tiffany protect its premium image while driving sustainable growth.

Brand Awareness & Brand Equity Indices

Tiffany & Co. enjoys exceptionally high global brand recognition, especially in the luxury jewelry and bridal category.

Key Brand Indicators:

- Consistently ranked among the Top 10 global luxury jewelry brands

- Very high unaided brand recall in North America, Europe, and Japan

- Strong emotional association with love, engagement, and heritage

Luxury brand studies indicate that Tiffany scores above industry average on trust and brand desirability, particularly among:

- Bridal buyers

- High-income millennials

- Luxury gift purchasers

Marketing Insight:

Strong brand equity allows Tiffany to:

- Maintain premium pricing

- Reduce dependence on discount-led marketing

- Achieve high conversion with lower ad frequency

Brand awareness acts as the foundation KPI, supporting all other performance metrics.

Engagement & Social Reach Performance

Digital engagement is a key growth driver, especially among younger luxury consumers.

Social Media Scale (Approximate):

- Instagram followers: 16+ million

- High engagement on product launches, celebrity campaigns, and gifting seasons

- Strong user interaction on reels, short videos, and visual storytelling posts

Engagement Highlights:

- Above-average engagement rates for luxury category benchmarks

- Strong performance on campaign hashtags (e.g., product lines, gifting moments)

- Influencer and ambassador content delivers higher save and share rates than standard posts

On YouTube and digital video platforms:

- Campaign films generate high completion and recall rates

- Success is measured more through brand lift and sentiment, not just views

Marketing Insight:

Tiffany prioritizes quality engagement over volume, focusing on emotional resonance rather than viral reach.

Conversion Metrics (E-commerce & Store Traffic)

Tiffany’s conversion strategy balances online convenience with high-touch in-store experiences.

E-commerce Performance

- Estimated 15–20% of total revenue driven by online channels

- Strong performance in:

- Bridal research

- Gifting purchases

- Entry-level silver jewelry

- Higher-than-average conversion rates due to strong brand trust

Online platforms act as:

- A discovery and education tool

- A lead generator for in-store appointments

Physical Store Traffic & Conversion

- ~320 stores worldwide

- Flagship stores drive:

- Higher average order value (AOV)

- Stronger emotional connection

- Higher conversion for engagement rings and high jewelry

Store visits often begin online, showing strong omni-channel behavior:

- Website → appointment booking → in-store purchase

- Social media → product discovery → store visit

Marketing Insight:

Tiffany’s strongest conversions happen when digital inspiration meets physical experience.

Overall KPI Strategy Summary

Tiffany & Co. measures success through:

- Brand equity over short-term ROAS

- Engagement quality over raw reach

- Lifetime customer value over single transactions

Conclusion & Key Learnings

Tiffany’s Timeless Heritage Meets Modern Cultural Relevance

Tiffany & Co. stands as a powerful example of how a heritage brand can stay relevant in a fast-changing world. Founded in 1837, the brand has successfully carried its timeless values of love, craftsmanship, and elegance into the modern luxury landscape.

Rather than changing its identity, Tiffany has refreshed how it communicates. Through modern design lines, celebrity ambassadors, and strong digital storytelling, the brand connects with younger audiences while still honoring its history. The iconic Tiffany Blue, the engagement ring legacy, and emotional gifting stories continue to act as strong brand anchors.

Tiffany proves that luxury brands do not need to chase trends aggressively. By respecting heritage and selectively embracing modern culture, the brand stays both relevant and aspirational.

Key Luxury Marketing Lessons from Tiffany & Co.

Tiffany’s marketing strategy offers several important lessons for luxury and premium brands:

- Heritage Is a Competitive Advantage

Tiffany uses its long history as a storytelling asset, not as a limitation. The brand’s legacy builds instant trust and emotional value. - Emotion Sells More Than Promotion

Instead of discounts or heavy performance ads, Tiffany focuses on love, milestones, and meaningful moments. This emotional connection creates deeper brand loyalty. - Consistency Builds Brand Power

From store design to social media visuals, Tiffany maintains a consistent look, tone, and message across all touchpoints. This consistency strengthens brand recall. - Modern Culture Can Be Selective

Celebrity partnerships and pop-culture collaborations are carefully chosen to match brand values, not just generate hype. - Brand Equity Beats Short-Term ROAS

Tiffany prioritizes long-term brand strength over immediate returns. This approach protects pricing power and increases lifetime customer value.

Final Insight

Tiffany & Co.’s success shows that true luxury marketing is about meaning, not noise. By balancing heritage with modern storytelling, the brand remains emotionally relevant across generations.

For any premium brand, Tiffany offers a clear roadmap: Build trust, protect your identity, and let emotion lead the marketing.